What is a Stop Loss strategy while day trading?

Contents:

Most markets have single-price auctions toward the start or open and the end or close of customary trading. A few markets may likewise have before-lunch and after-lunch orders. Order might be determined on the close or on the open at that point it is entered in an auction yet has no impact in any case. There is regularly some cut off time, for instance, orders must be in a short time before the auction. They are single-price since all orders, on the off chance that they execute by any means, execute at a similar price, the open price and the close price individually.

A trailing stop is simply a Stop-Loss Order which combines both risk management as well as trade management. Hence the stop loss trail with the last traded price in one direction. This is significant when traders want to protect their gains in a position. This order type allows traders to avoid knee-jerk decisions based on emotions and helps them to execute pre-determined trading plans.

Stop Loss Meaning – What is stop loss order in the share market?

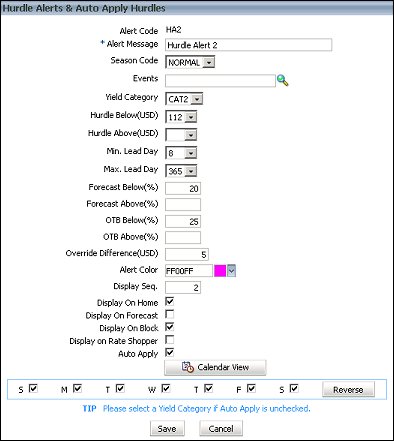

Quality scores above 55 are considered good and below 35 are considered bad . Whereas, scores between are considered neutral/Medium/Middle . To get access please email on from your registered email-id or contact you Relationship Manager. If you see ‘tsl_flag’ in the column under the ‘key’ column, and an attribute of ‘1’ next to it, your TSL feature has been activated. Going forward the system will keep checking for the ‘profit increased by’ value set. Once the overall profit is greater than the ‘activate at’ price and the ‘profit increased by’ price, the TSL will now shift from zero to the number you set here.

Besides, a when should you buy an annuityr can leave the trade for a particular day while he/she knows there will be no losses or minimal losses due to stop-loss orders when they are busy having a vacation or on a trip. However, when the share price increases, the trailing order instantly adjusts in tune with an entire increase in market valuation. Some apply it well to prevent losses from their investing journey, while some avoid it due to insufficient knowledge on stop-loss.

Read More News on

You are willing to take a maximum risk of Rs.10, then your stop loss should be placed at Rs.930. If Infosys touches Rs.930, you just book the loss and terminate the position. Alternatively, assume that you have sold 50 TCS shares at Rs.2345 and are willing to take a maximum risk of Rs.20. Since this is a short position, you can place the stop loss at Rs.2365. Some media has alluded to the fact that our rapid diversification in last few years has resulted in this situation.

- Typically what I would recommend is that for an audit on the upside, you have to give a price a little higher.

- So if the order gets triggered by a GTT and it, for some reason, let’s say, did not get filled.

- Remember the key point that while choosing a stop loss is that it should allow the stock to fluctuate day-to-day while preventing the downside risk as much as possible.

- Another limitation with the stop-loss order is that many brokers do not enable you to put a stop order on certain assets like OTC Bulletin Board stocks or penny stocks.

- The order itself states emphatically, that this is in response to preliminary findings and is subject to further review upon a more comprehensive audit and investigation.

The stop loss order is primarily meant to limit your loss on a stock that you have already purchased. The moral of the story is that irrespective of the method you use, the idea of keeping stop loss is mandatory. You must never try to trade intraday without proper stop losses in place. That is like insurance and protects your capital and also ensures longevity as an intraday trader for a longer period. “Investments in securities market are subject to market risk, read all the related documents carefully before investing.

Download one of India’s best wealth management apps

On the site we feature industry and political leaders, entrepreneurs, and trend setters. The research, personal finance and market tutorial sections are widely followed by students, academia, corporates and investors among others. No need to issue cheques by investors while subscribing to IPO. No worries for refund as the money remains in investor’s account.” 4) No need to issue cheques by investors while subscribing to IPO.

Such types of ordehttps://1investing.in/ work towards limiting the loss of investors in a specific position. Many novice traders can end up making large losses in their trading journey due to poor position sizing, overleveraging, and not using a stop loss. Hence, it is essential to understand stop-loss, a popular risk management tool used by traders and investors to limit potential losses in a stock or other security.

Building Versus Buying: What Carriers Must Think About When … – Workers Comp Forum

Building Versus Buying: What Carriers Must Think About When ….

Posted: Sun, 09 Apr 2023 15:26:31 GMT [source]

There is another type of stop-loss order known as a trailing stop-loss order. In such a strategy, the threshold point is set, and above which, if the losses increase, it can execute itself and bring the trader out of the trade. While using stop-loss, investors have to take a call and need to decide which price is to be set while stocks are falling. It is a very tricky part for investors, but they can seek help from financial advisors with the help of their contacts.

Stop-Loss is one the most beneficial tool that helps investors from huge losses. While many investors are unfamiliar with these terms like stop loss or stop-loss order, it can serve as a lifesaver. Stock brokers can accept securities as margins from clients only by way of pledge in the depository system w. Yes, you can buy a stock and set a stop loss at the same time.

At times, stop-loss orders are used to prevent investor losses when the price of a security drops. For example, a trader may buy a stock and places a stop-loss order 10 per cent below the purchase price. When the price drops, the stop-loss order gets activated, and the stock gets sold as a market order.

Kindly don’t trust such kinds of messages from any unauthorized persons. All that is required is to visit your application wherein you will find an option- “Add Stop Loss”, click on it and choose the amount or set an exact rate. A trader should know where his stop is going to be before he takes the position. The benefit of ascertaining your stop loss before you open trade is that it removes any emotions from the decision. For example, using the moving average you can place a stop loss just below the longer period moving average than a shorter period moving average.

- There is another type of stop-loss order known as a trailing stop-loss order.

- Some media has alluded to the fact that our rapid diversification in last few years has resulted in this situation.

- It is a trading strategy used to limit losses by exiting a trade at a predetermined price level when the market moves against your position.

With all said and done, the simplest way to understand a stop loss order is that it is simply an order opposite to your trade position. When the Last Traded Price touches the Trigger Price, then a Limit Order gets placed on the Stock Exchange. So, this means that the trader has to put a fixed Trade Price at order placement time.

This is the good old stop-loss order for the intraday purpose, but that’s not the GTT order that we just placed. For that, you have to go to the GTT tab and you can see here that this order is here. In this case, if Jindal Steel and Power comes down to, let’s say 201 rupees, or I can even give in terms of percentage, let’s say 15% from here. So 15% we’ll bring it down to 193, or if I want to give an absolute number, I can say 200 hundred prices.

Trade Brains is a Stock market analytics and education service platform in India with a mission to simplify stock market investing. Although there are few limitations of using stop loss, however, it is a very useful tool to limit your losses. A big loss in one trading session might erode the profits of your last ten successful tradings. However, during the pre-opening session, the stock opened on a gap-down at a price of Rs 90.

댓글을 남겨주세요

Want to join the discussion?Feel free to contribute!